Preparing to Purchase a Self Storage Facility, Part 3: Timeline of a Transaction

You’ve found the perfect self storage facility to buy. You’ve reviewed the work involved with your team of professionals, and feel confident that this property meets your investing goals. What’s next?

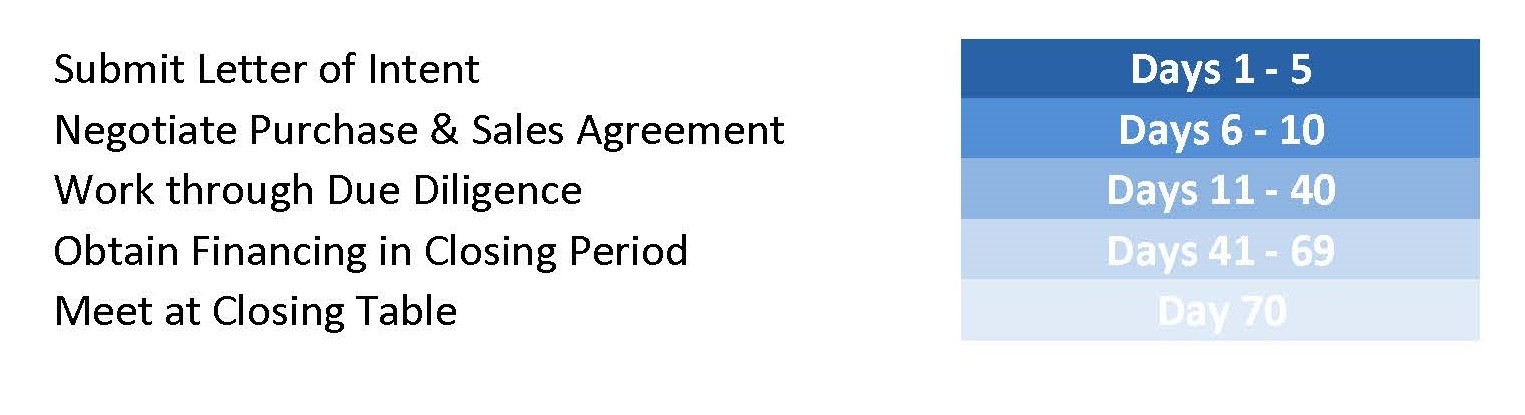

In Part 1, we covered the members you’ll need on your team before you even start looking at properties. In Part 2, we looked at team members who can help you evaluate and close on deals. With a solid team in place, the responsibility for managing the timeline of the transaction falls on you. Here are the steps you’ll need to take to get to the closing table:

1. Submit a Letter of Intent

The letter of intent, or LOI for short, is the first step in initiating a transaction. Typically only a few pages long, this document spells out the basic terms that you’re willing to offer – price, deposits for due diligence, days in due diligence, days to close, and who is paying the broker’s commission. Other elements typically included are a financing contingency (buyer must obtain at least a minimum percentage of loan to value in order for the sale to proceed), how pro-rations and closing costs will be handled, and an agreement that upon acceptance of the LOI by the seller, that the seller will not negotiate with other parties. The final element of a typical LOI is an expiration date – a stipulation that if the LOI is not agreed to by a certain date, that the LOI will be retracted.

Typically a LOI is not considered legally binding, but please consult your real estate attorney before submitting a LOI. They should be able to provide you with a form letter of intent, as well as customize it for your specific needs.

2. Negotiate a Purchase & Sale Agreement

The Purchase & Sales Agreement (PSA) is a legally binding agreement between seller and buyer that “sets in stone” the basic terms agreed upon in the letter of intent, and elaborates on them. It also outlines due diligence documents required, seller’s obligations in the sale, and conditions under which the agreement would be invalid or terminated.

The LOI covers the largest, most important elements of the transaction, and ensures that seller and buyer are on the same page. The PSA outlines the details and makes the agreement legally binding. The PSA typically ranges from 10-50 pages.

Typically there is a period of several days in which the seller and buyer discuss and negotiate terms in the agreement before signing it and moving into due diligence.

3. Work through Due Diligence

Due diligence is typically a 30 day period in which you review the physical property, the financial records for the property, and the local market. Verifying that all of the information that you have received is accurate and complete is important, and will help you understand what you need to do when you take over the property. Your broker should be able to explain to you what is considered normal due diligence and what may be considered excessive or not necessary.

4. Obtain Financing in Closing Period

Typically a closing period is 30 days, and banks are able to provide financing in that time frame. You’ll need to have all of the necessary due diligence documents collected, though, for banks to evaluate the property and offer financing. It is also wise to have a phase one environmental study completed during the due diligence period, once you’ve decided that you want to move forward with the property, because they can take several weeks. If you have a bank selected for financing, and they just need two or three weeks to complete the underwriting on the property, it is also wise to ask them to order the appraisal on the property as soon as possible.

This closing period is where the most deals struggle to reach the finish line, and the underlying reason is almost always a loss of momentum. The buyer is 100% responsible for providing funds for the purchase of the property, and it can be very frustrating for sellers to provide an extension of this time period if they feel that the buyer has not done everything in their power to obtain financing. Nearly all of the self storage properties that we sell have multiple buyers interested, with offers that are close to yours in price. Many sellers will not hesitate to terminate the transaction with you and begin negotiating with another buyer if they do not feel that you are upholding your end of the agreement. For many buyers and sellers, the self storage property can represent more than just an investment – it is their retirement fund, a project they poured years into, or a path to the financial future they dream about. Those emotions can hijack the transaction if you’re not careful – helping seller and buyer through conflicts is one of the biggest services that a broker provides.

5. Meet at Closing Table

You’ve made it to the closing table. Congratulations! You’ve worked hard to reach this point. Here’s a recap of the entire timeline you’ve gone through:

Our brokerage team is happy to help you achieve your investing goals. If you are ready to buy a self storage property, you can contact us today and we’ll get you on the path to success.